Context: 0–1 Startup Bank · Mobile + Web Banking, Investing, Credit, Insurance

Role: Sr. Lead Product Designer · Fintech SME

Timeline: 2022

GloriFi

Creating a values-driven banking platform for a new kind of customer

GloriFi launched as a mission-led fintech startup aiming to offer an alternative to traditional financial institutions. Rather than building “just another banking app,” the company sought to create a holistic financial ecosystem aligned with a specific set of customer priorities — emphasizing financial independence, personal responsibility, and a more transparent relationship with money.

My role was to design the end-to-end banking and brokerage experience from the ground up. Working in a fast-moving startup environment, I shaped the mobile-first IA, created complete UX flows, and partnered with engineering to bring a complex financial product to life.

01

Understanding the Current Needs

Why a New Kind of Financial Platform Was Being Built

As a 0–1 startup, GloriFi entered the market with a unique challenge: translate a highly mission-driven identity into a functional, trustworthy, mainstream-ready financial product.

User and market research revealed several key motivations:

Many users felt underserved or overlooked by existing financial institutions.

Traditional banks appeared bloated, slow, or misaligned with customers’ personal values.

Users wanted a platform that felt more transparent, more intuitive, and more aligned with how they viewed financial responsibility.

New-to-finance audiences needed simple, predictable workflows — not jargon or complexity.

Competitors often separated banking, insurance, and investing into disconnected experiences.

The design challenge was to take a values-centric brand and build a modern, inclusive, and easy-to-use fintech platform that anyone could navigate confidently.

02

Identifying Key Friction

Where Traditional Banking Falls Short

Competitive research across banking, trading, and insurance platforms highlighted core UX gaps we needed to solve:

Disconnected experiences between products

Overcomplicated account flows

Confusing payment and funding pathways

High onboarding friction for multi-product users

Mobile designs that didn’t scale gracefully from desktop

These insights helped us define a unified IA and consistent UX patterns across checking, savings, credit, insurance, and investing.

03

Designing a Unified Financial Experience

Creating One Cohesive Money Experience

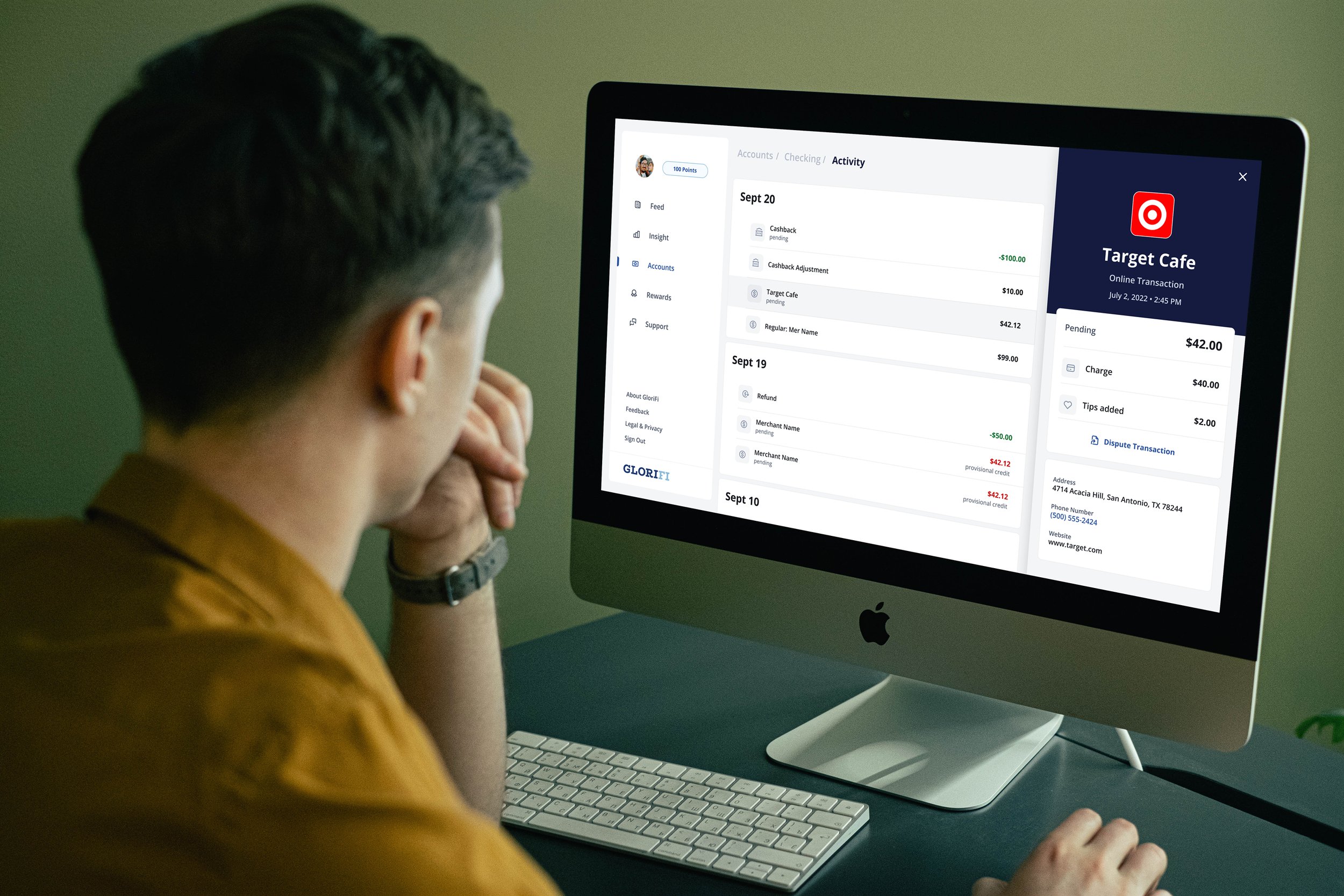

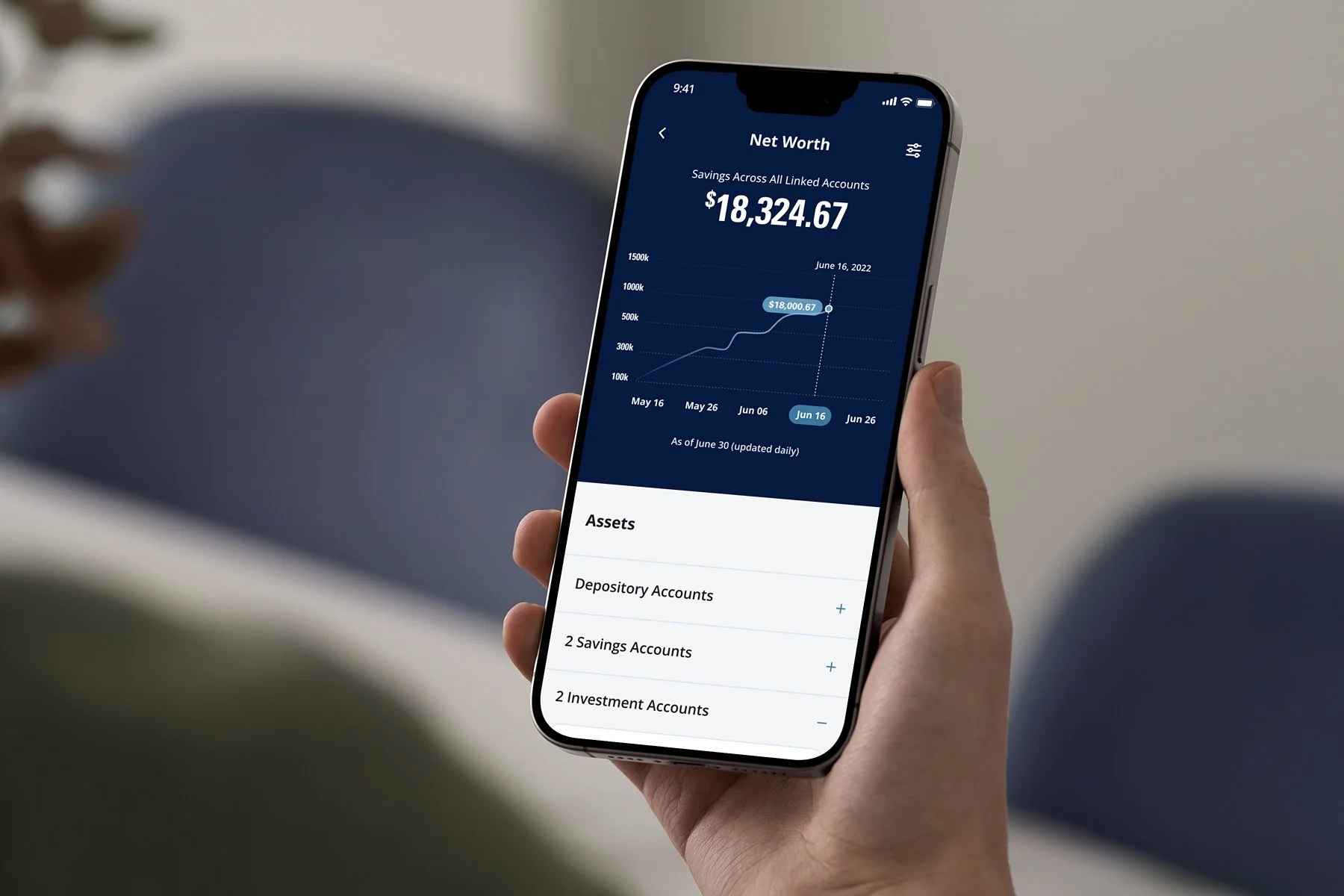

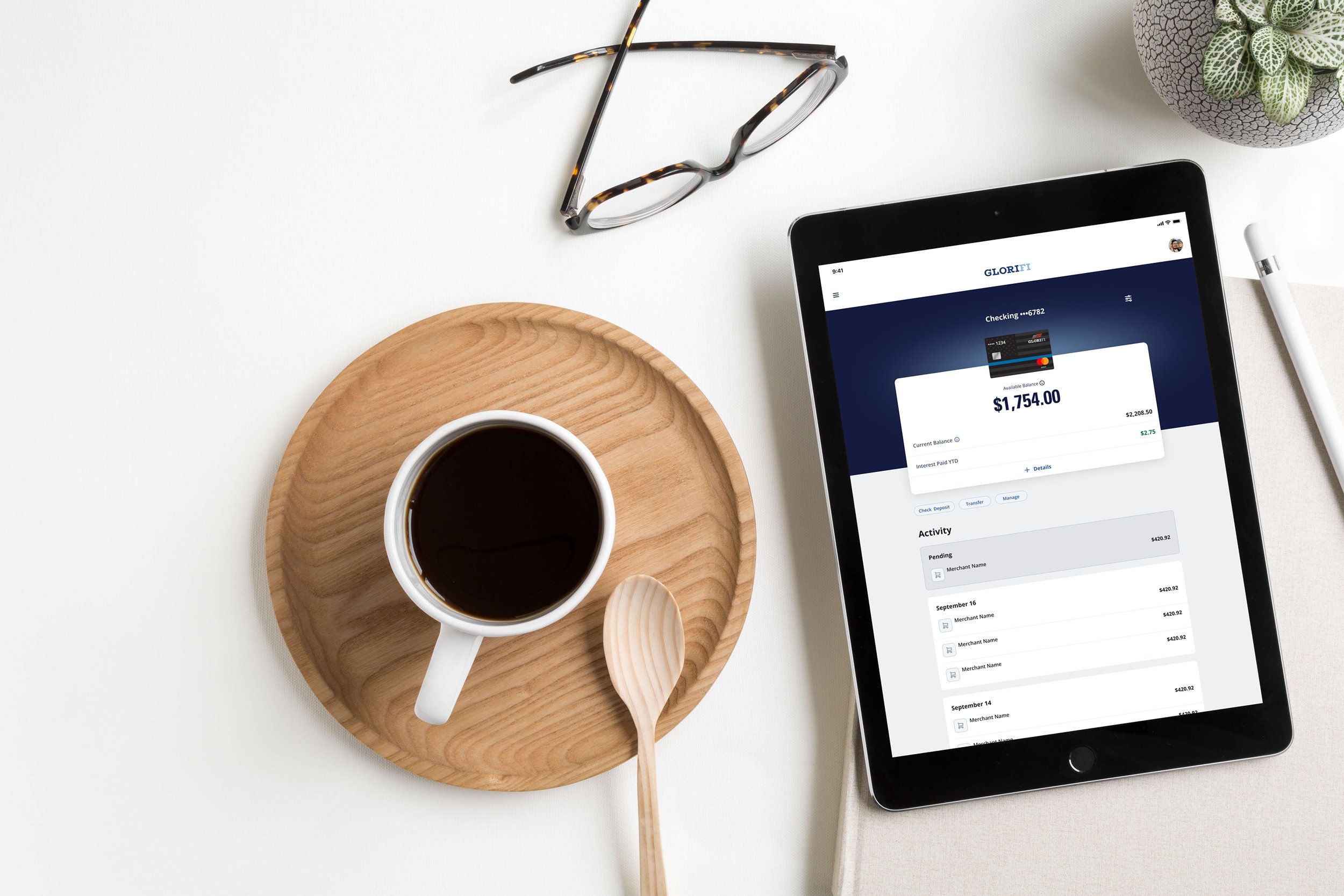

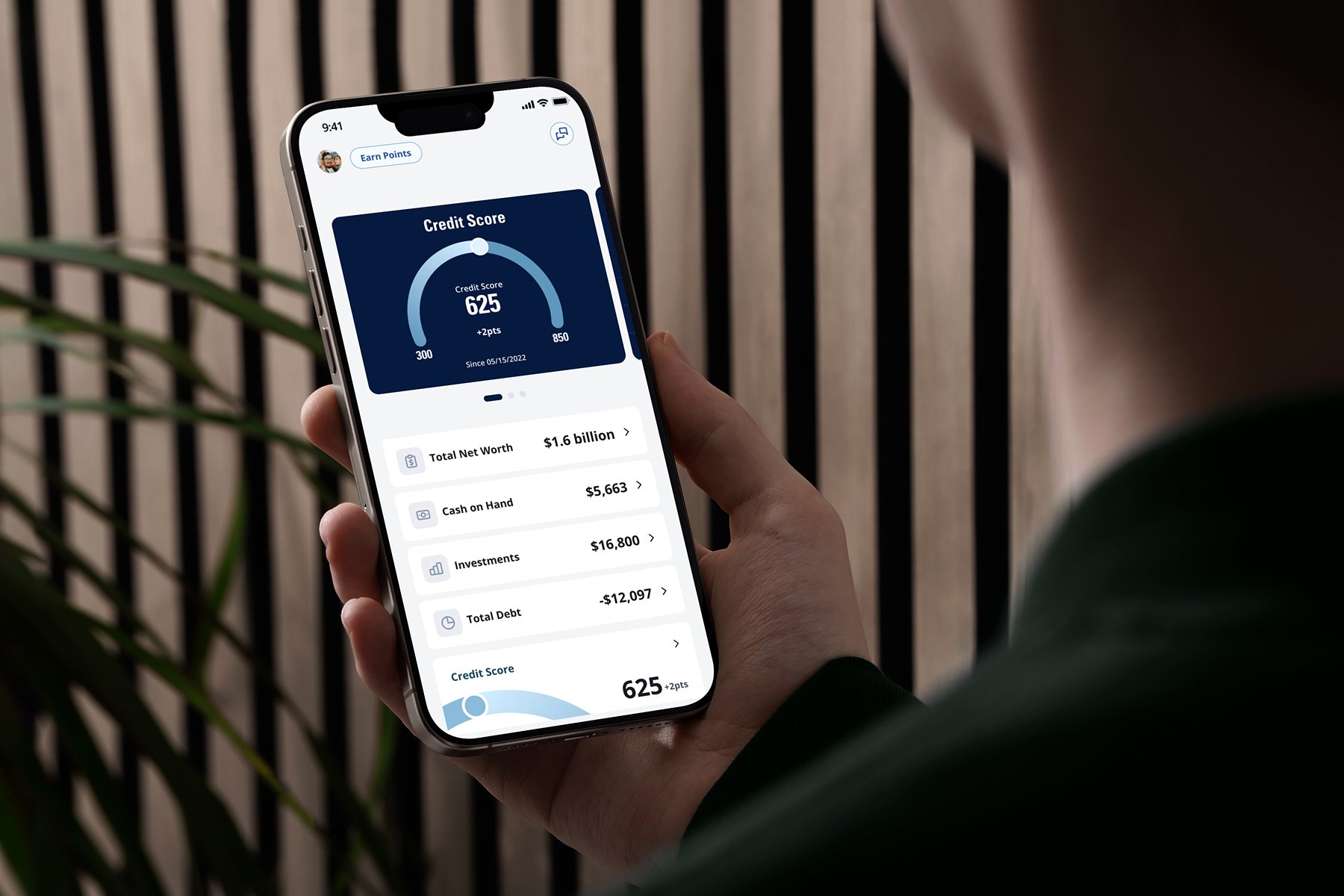

My work centered on simplifying a multi-product ecosystem into clean, modern flows users could trust.

What I Delivered

Clear, mobile-first banking flows

For transfers, deposits, bill pay, account linking, and everyday money movement.Brokerage & investing UX

Fractional shares, ETFs, and advanced order types — designed to be approachable to newcomers.Unified navigation & IA

A single framework connecting banking, credit, insurance, and investing.Streamlined onboarding

Reduced barriers across KYC, funding, insurance eligibility, and brokerage compliance.Modular product cards

Credit, savings, and insurance modules that adapted to user needs.Responsive design system

Consistency across desktop and mobile without duplicating work.

Result: A cohesive 0–1 fintech platform that made complex financial tools feel simple, accessible, and aligned with users’ personal financial goals.

04

Results & Impact

Delivering a Complete 0-1 Fintech Platform

While GloriFi ultimately shut down due to financial and operational challenges unrelated to product/UX, the design work delivered substantial progress:

A full-system design across banking, credit, insurance, and brokerage

Hundreds of validated flows for both mobile and desktop

A complete brokerage onboarding + trading experience

A modernized banking UI that reduced cognitive load

A unified IA that brought all financial products under one coherent structure

This work demonstrated the viability of a mission-driven fintech platform — one that preserved its identity while delivering a modern, intuitive experience for a broad audience.