Context: White-Labeled Mobile Banking Platform

Role: Sr. Product Designer

Timeline: 2023

Deloitte Digital

Reimagining a 0–1 white-label banking app that made everyday money tasks feel faster, clearer, and actually enjoyable.

Deloitte Digital partnered with Matic Digital to build a mobile banking app that could be rebranded and deployed across multiple financial institutions. The challenge wasn’t adding more features—most banking apps technically work—the real problem was that simple tasks were buried behind too many taps, menus, and confusing decision points.

We set out to design something different: a mobile-first banking experience where the fundamentals felt obvious, predictable, and effortless. A platform that clients could customize without breaking the UX, and one that users could trust immediately.So that’s what I designed.

01

Understanding the Current Needs

Why Simple Banking Felt Hard

Before designing anything, I audited the apps people rely on most—Revolut, Monzo, Truebill, Stash, and several regional banks. The pattern was clear: the “basics” weren’t basic.

Too many steps to send money

Confusing flows for linking accounts

Disputes hidden behind unclear paths

Navigation that felt like guessing

For a 0–1 banking product to gain trust quickly, the fundamentals needed to feel obvious, predictable, and effortless.

02

Identifying Key Friction Points

Where Users Struggled Most

Research and competitive analysis revealed the core issues shaping our build: dense forms, inconsistent flows, and no mobile-first logic.

Tasks like funding, onboarding, and account linking carried unnecessary clicks and unclear guidance. White-label constraints also meant every variation risked breaking consistency.

We needed a foundation that reduced cognitive load, streamlined essential actions, and supported multiple clients without extra rework.

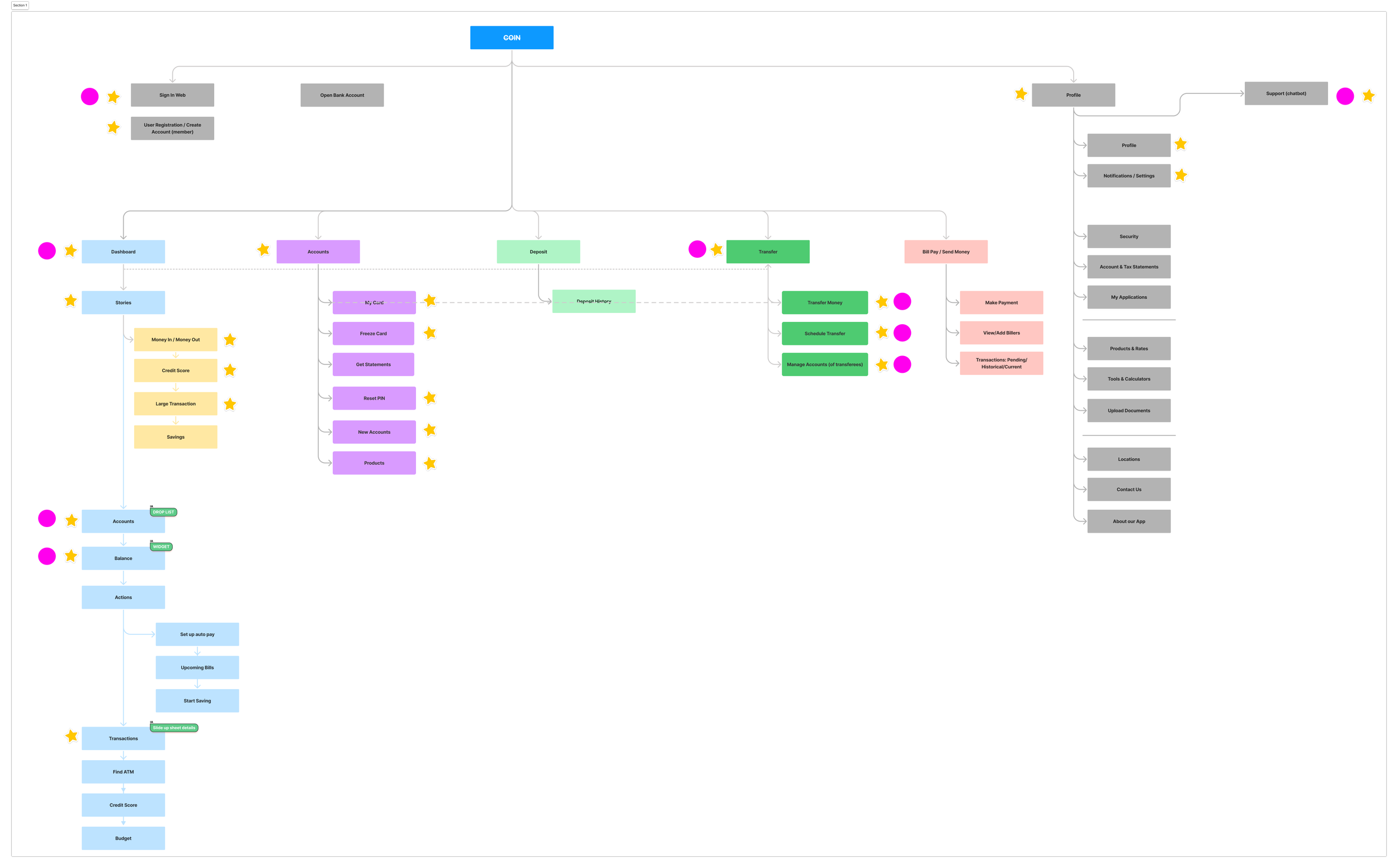

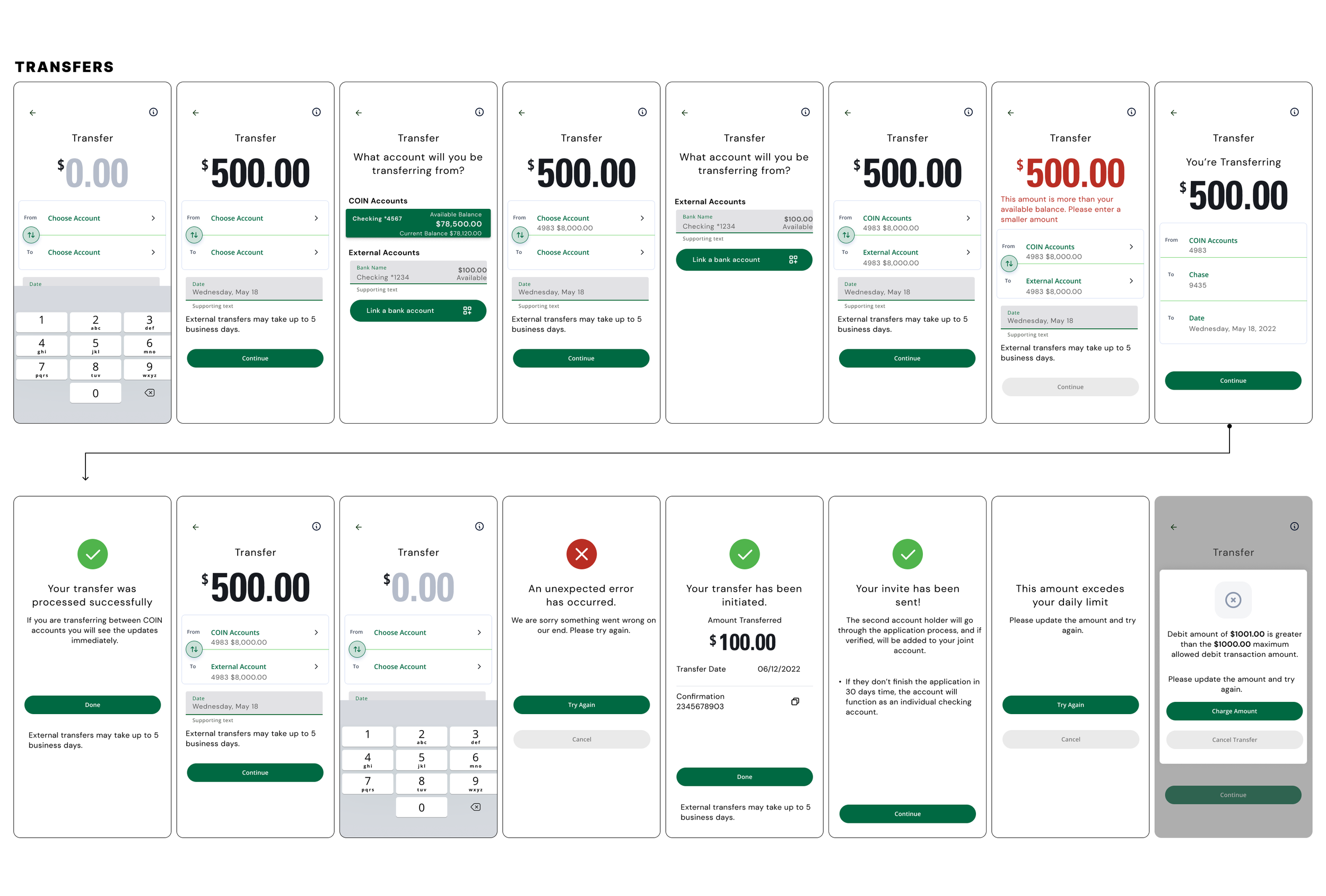

Mapping each feature flow and reducing steps was critical in making the experience easier than other standardized banking apps.

03

Designing a Modern Mobile Experience

Making Banking Feel Simple

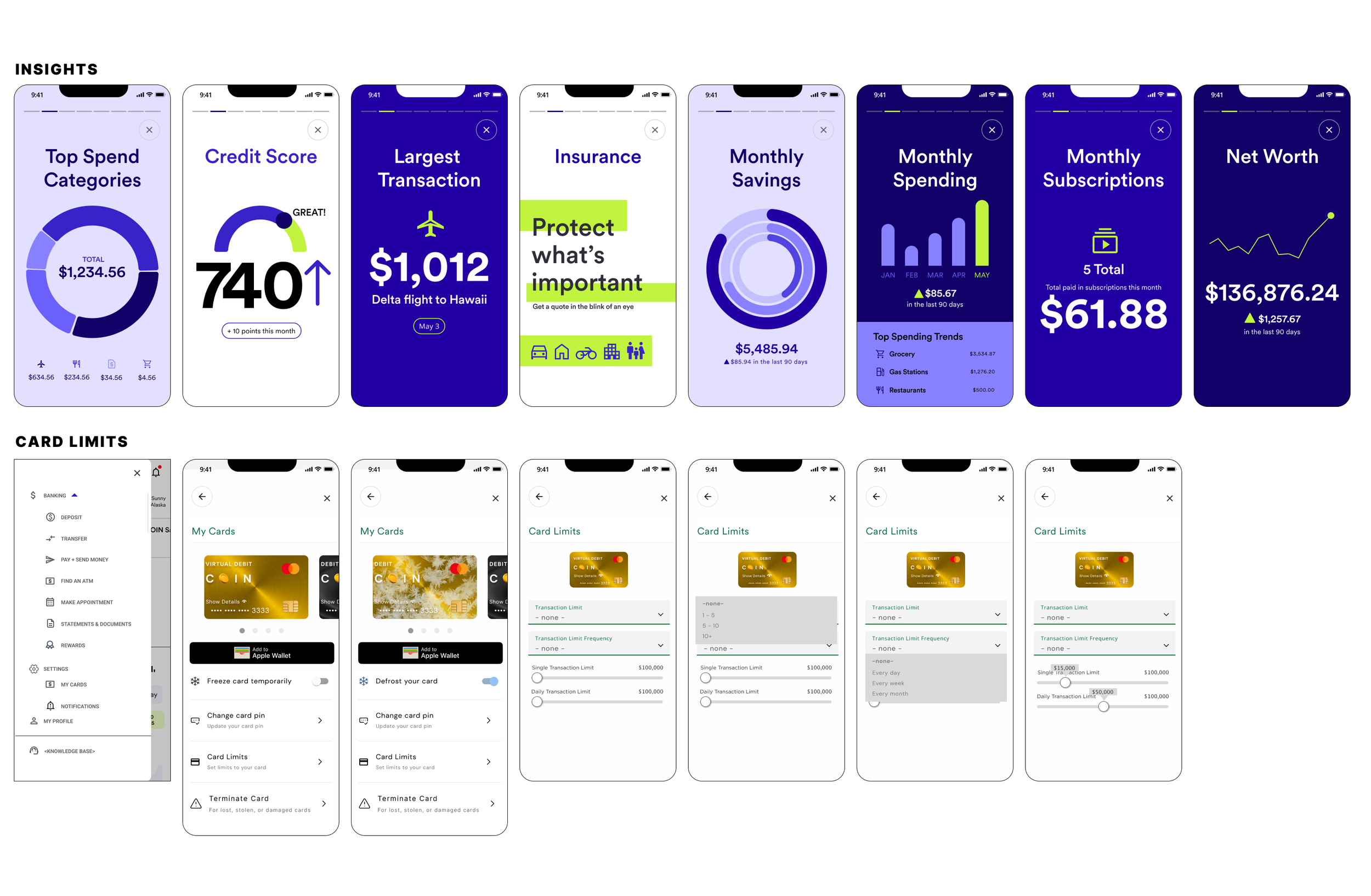

The design approach centered on creating a mobile-first experience where complex financial tasks felt fast and intuitive.

I built streamlined flows for KYC, funding, transfers, and linking accounts. A token-based design system enabled reusable components, easy rebranding, and tighter dev alignment.

A modern visual language—rounded tiles, clear hierarchy, airy spacing—helped the app feel trustworthy and friendly to a younger audience.

04

Results & Impact

A Scalable, Client-Ready Platform

The COIN MVP launched as a flexible, white-labeled banking system ready to support multiple financial institutions.

We simplified core banking actions, reduced friction across key tasks, and accelerated engineering through a reusable design system.

The result was a cohesive, mobile-native foundation that balanced clarity, usability, compliance, and cross-client scalability.