Context: Pioneering crypto startup focused on cross-border invoicing & payments

Role: Sr. Product Designer

Timeline: Mar 2022 – Oct 2022

Syro

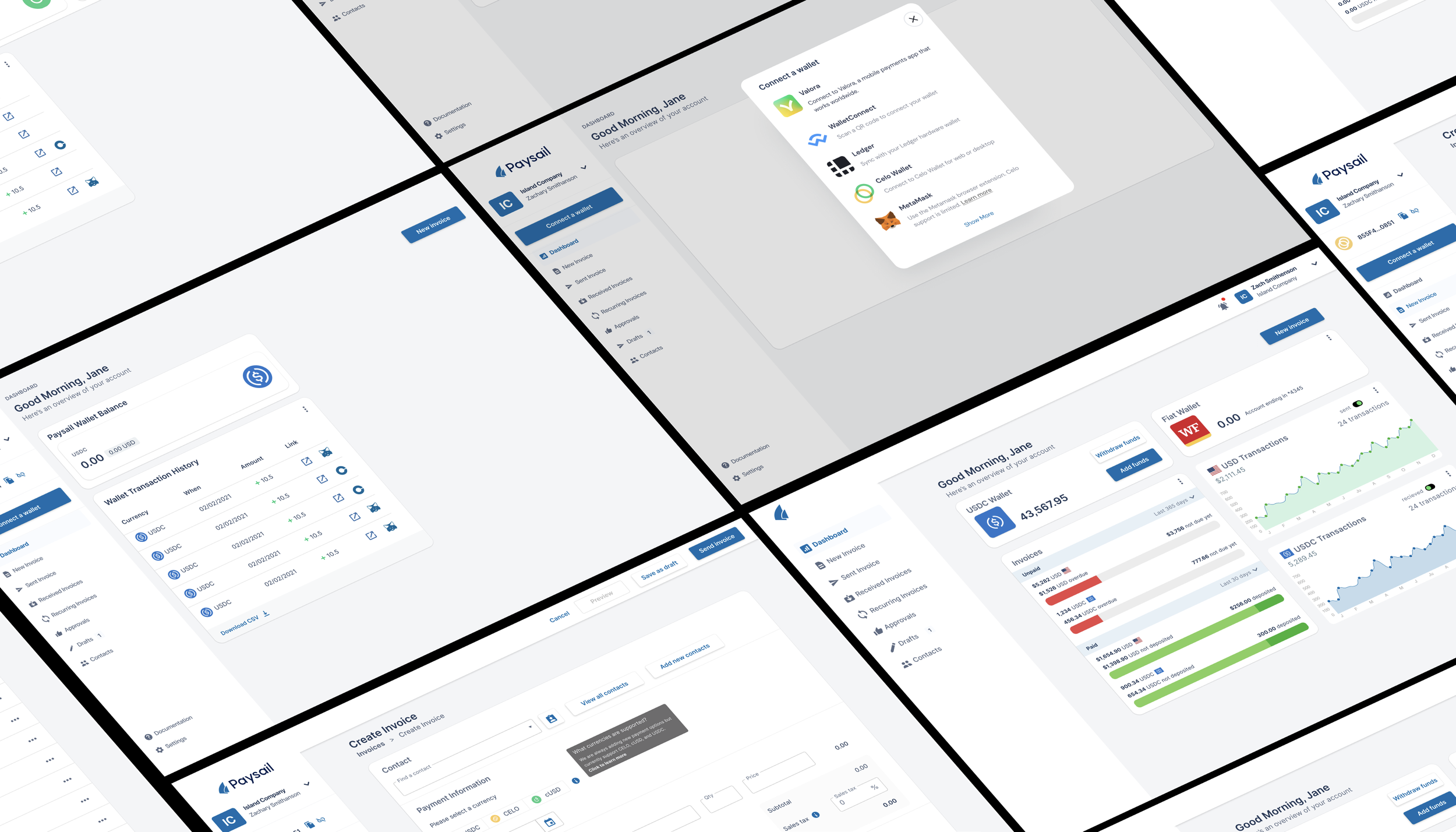

Designing Syro: A Web3 invoicing and cross-border payments platform built for speed, clarity, and global trust

Syro set out to solve one of the biggest pain points in global business: sending and receiving payments across borders using both fiat and crypto—without complexity. As the sole designer, I built a 0→1 desktop-first platform that blended regulatory compliance, smart contracts, and intuitive financial workflows into one seamless experience.

01

Understanding the Landscape

What Made Syro Different

Syro wasn’t just another invoicing app—it had to bridge the worlds of traditional finance and Web3. That meant designing a platform that felt familiar to small businesses while supporting advanced crypto functionality behind the scenes.

Key themes from early exploration:

Cross-Border Complexity — Businesses needed a faster, clearer way to send/receive payments internationally.

Non-Standard Crypto Invoicing — Traditional invoice tools didn’t support crypto assets, chain settlement, or multi-currency contracts.

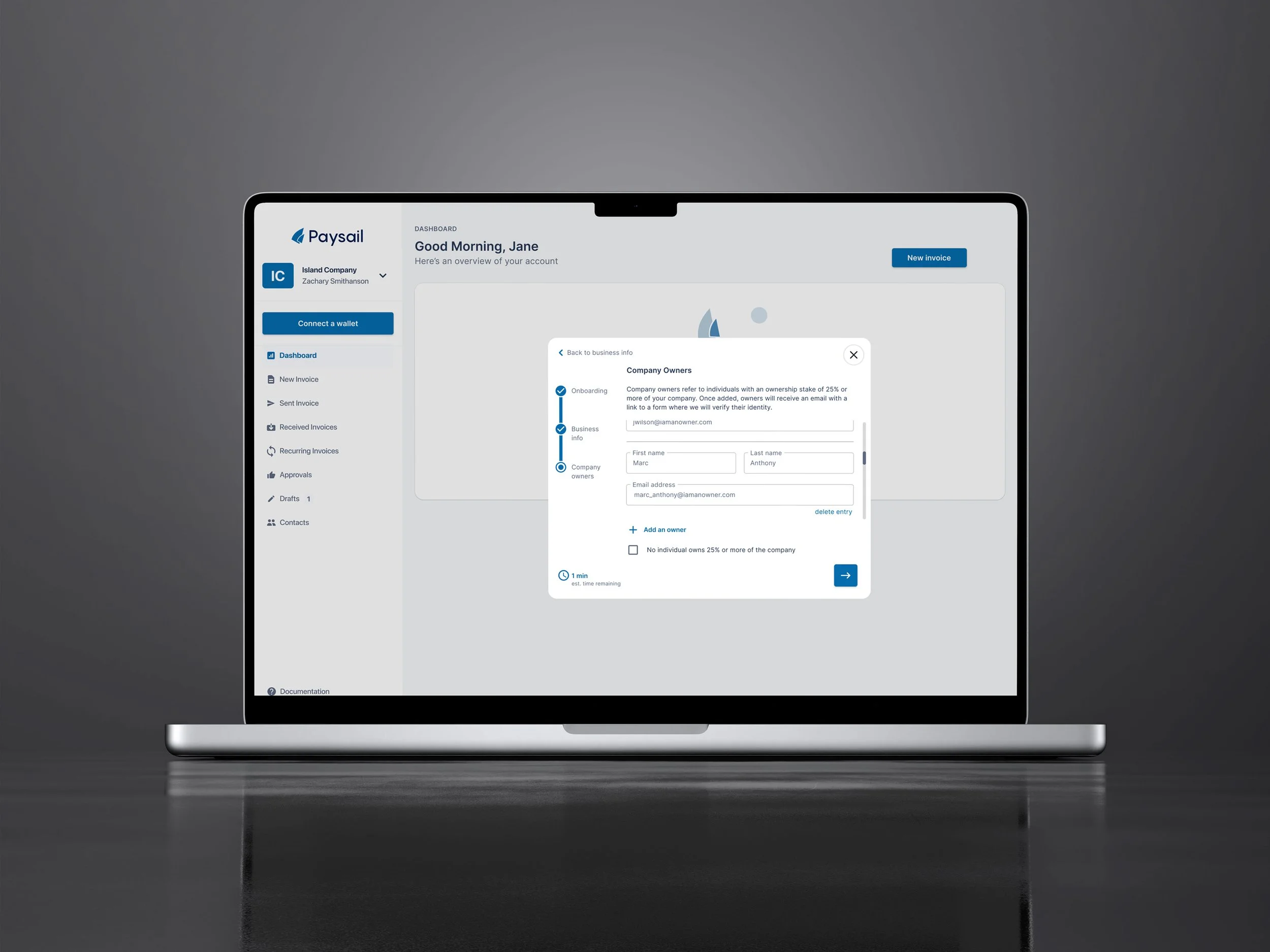

Compliance & Trust — KYC, KYB, and AML requirements had to be woven into the experience without adding friction.

Mixed Payment Reality — Many invoices combined fiat and crypto, requiring flexible tracking models.

Zero-To-One Desktop MVP — With no existing baseline, every workflow, pattern, and system had to be created from scratch.

User Flows

02

Defining the Core Problem

Where Users Struggled

During research, patterns emerged around how difficult it was for small teams to manage cross-border invoicing:

Fragmented Tools — Users juggled spreadsheets, wallets, banking apps, and manual calculations.

Unclear Money Flow — People lacked visibility into wallet balances, incoming/outgoing payments, and invoice status.

Crypto Confusion — Most users didn’t understand chains, tokens, or settlement behavior.

Regulatory Overload — Compliance flows were intimidating, unclear, or overly rigid.

No Existing Standards — There was no “template” for crypto invoicing, meaning the UX needed to define best practices.

These insights shaped the core design direction: simplify the interface, clarify financial flows, and hide complexity behind intuitive patterns.

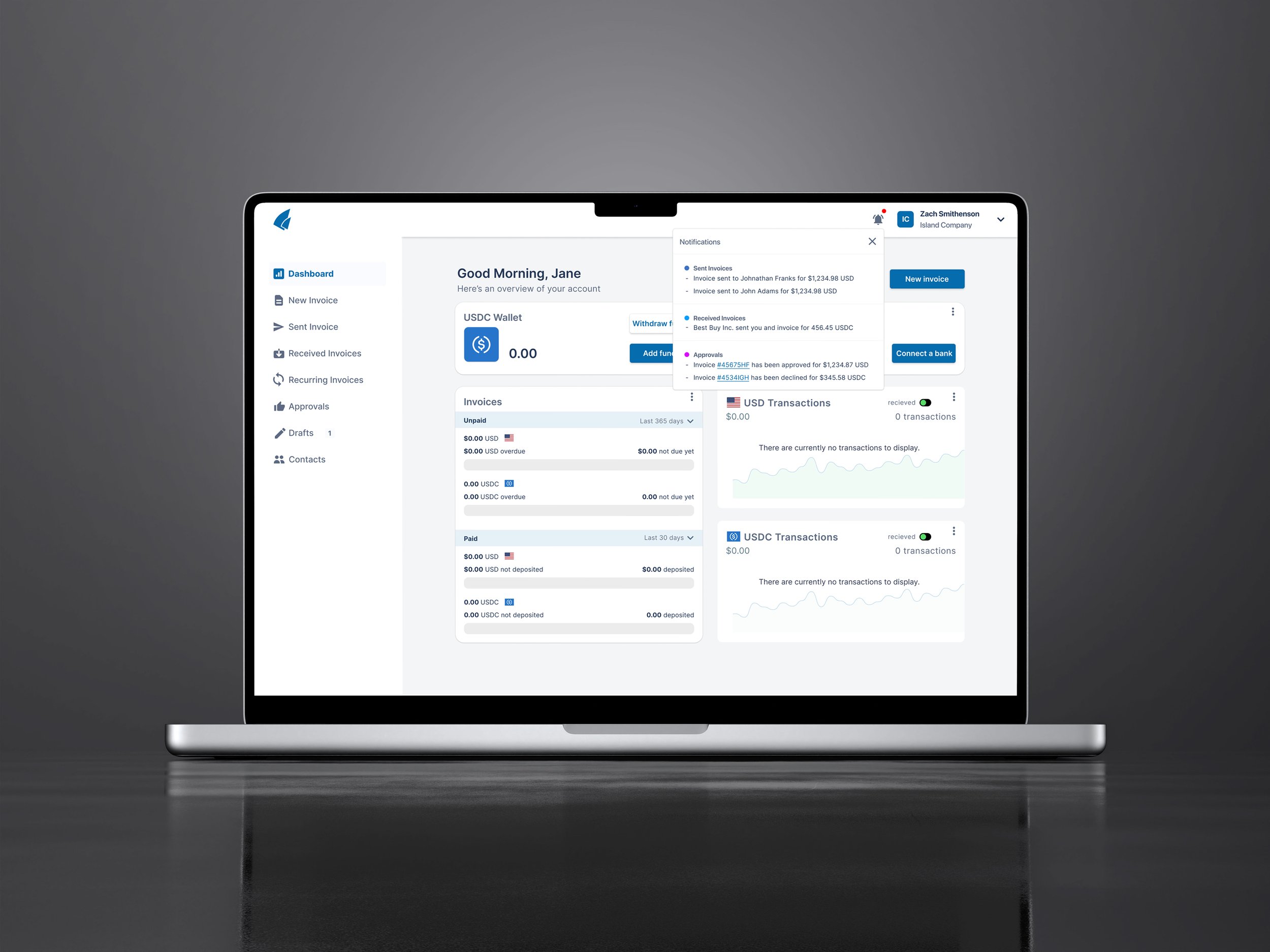

Invoicing Dashboard

Invoicing Dashboard Default state w/ Notifications

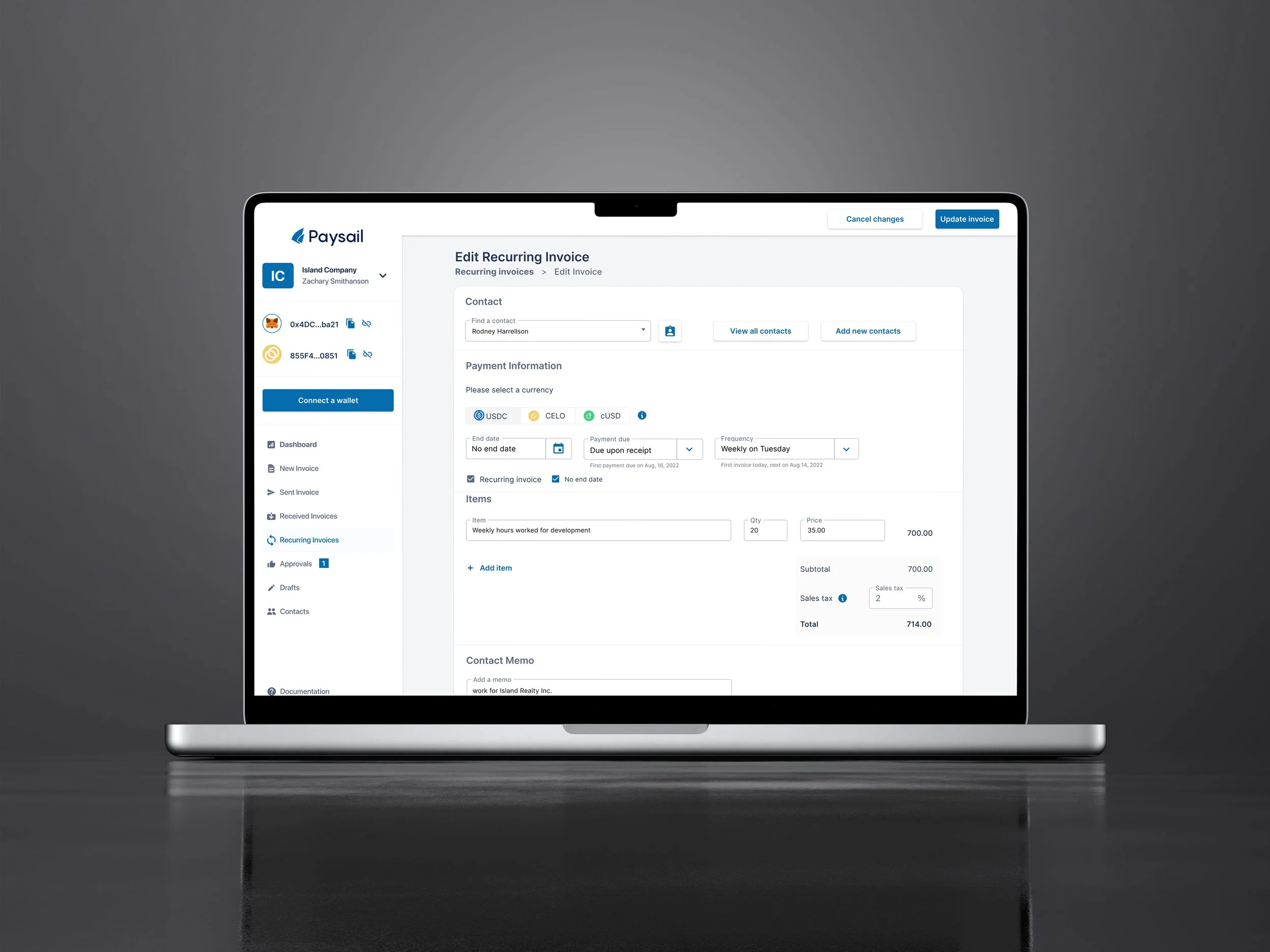

Recurring Invoice

Invoice History

Drawer Modal

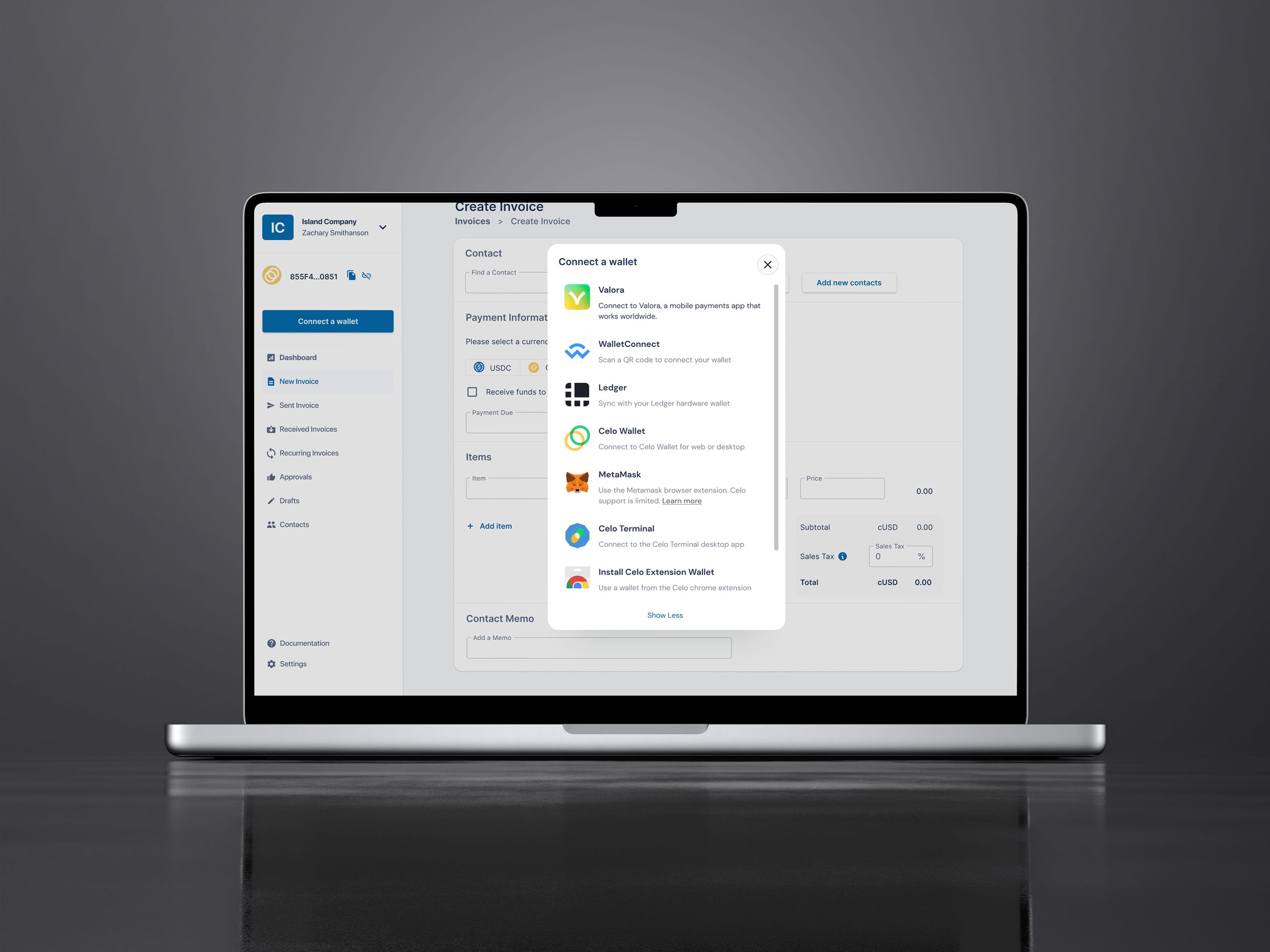

Wallet Modal Selection

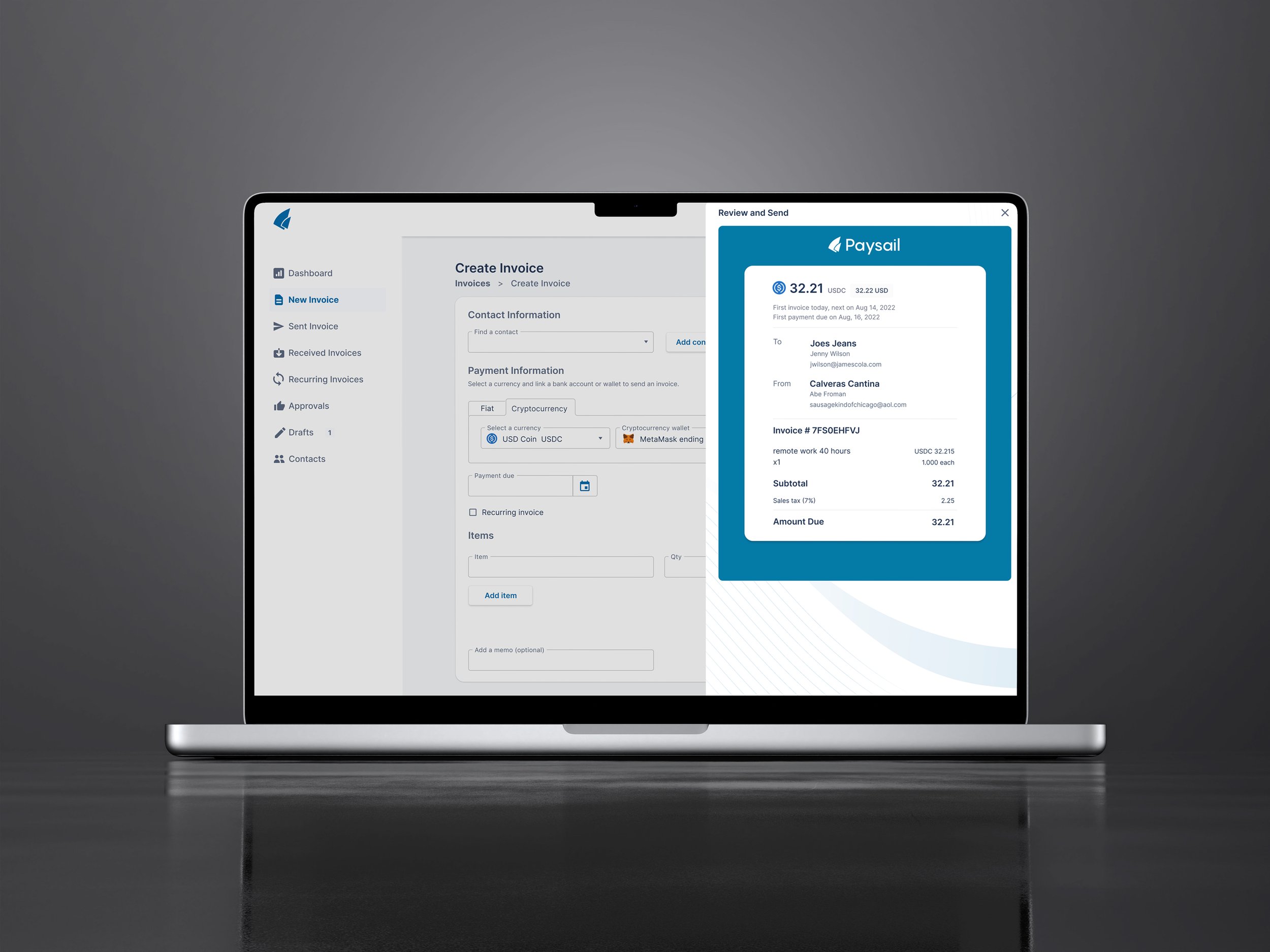

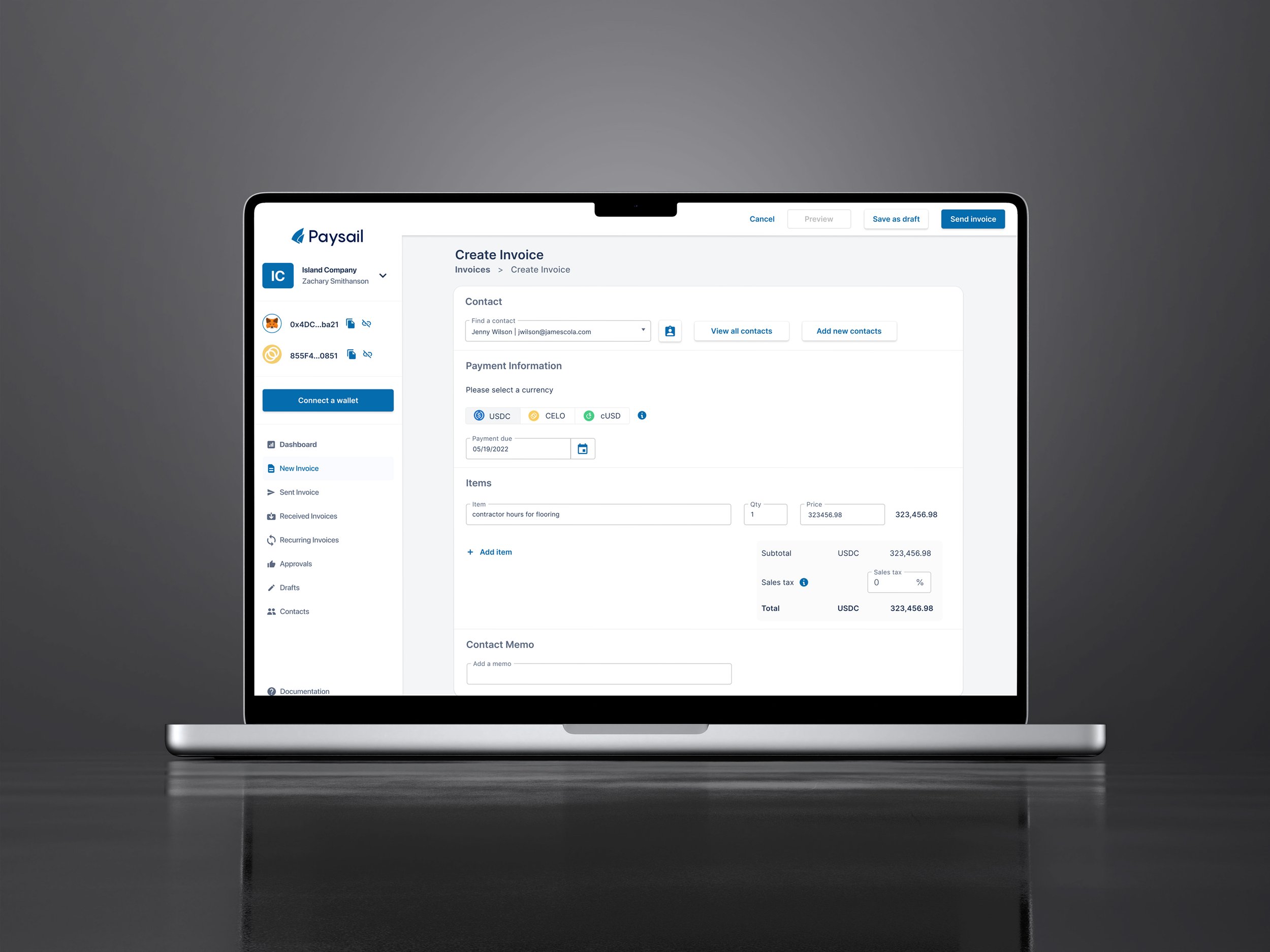

Create Invoice

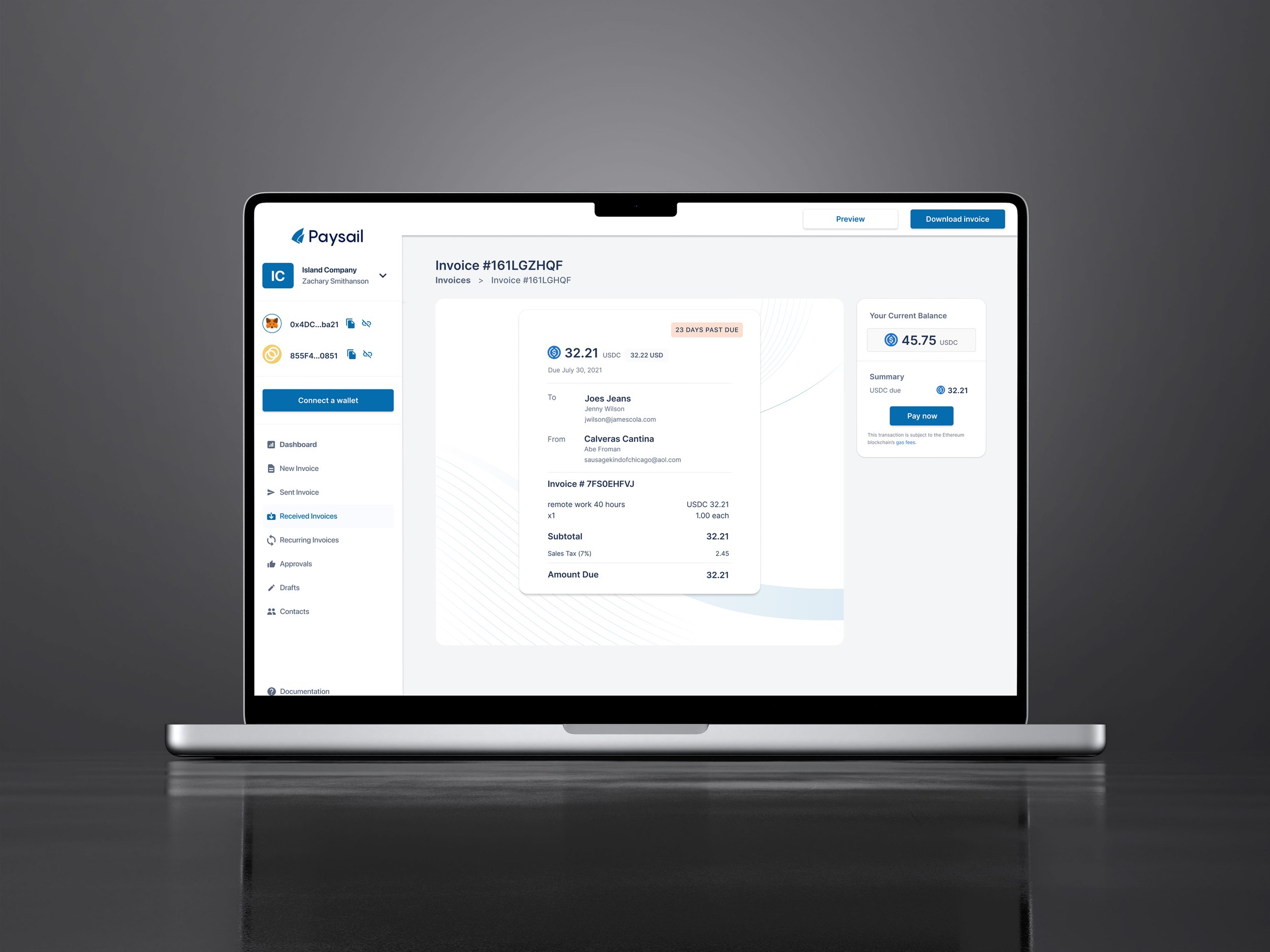

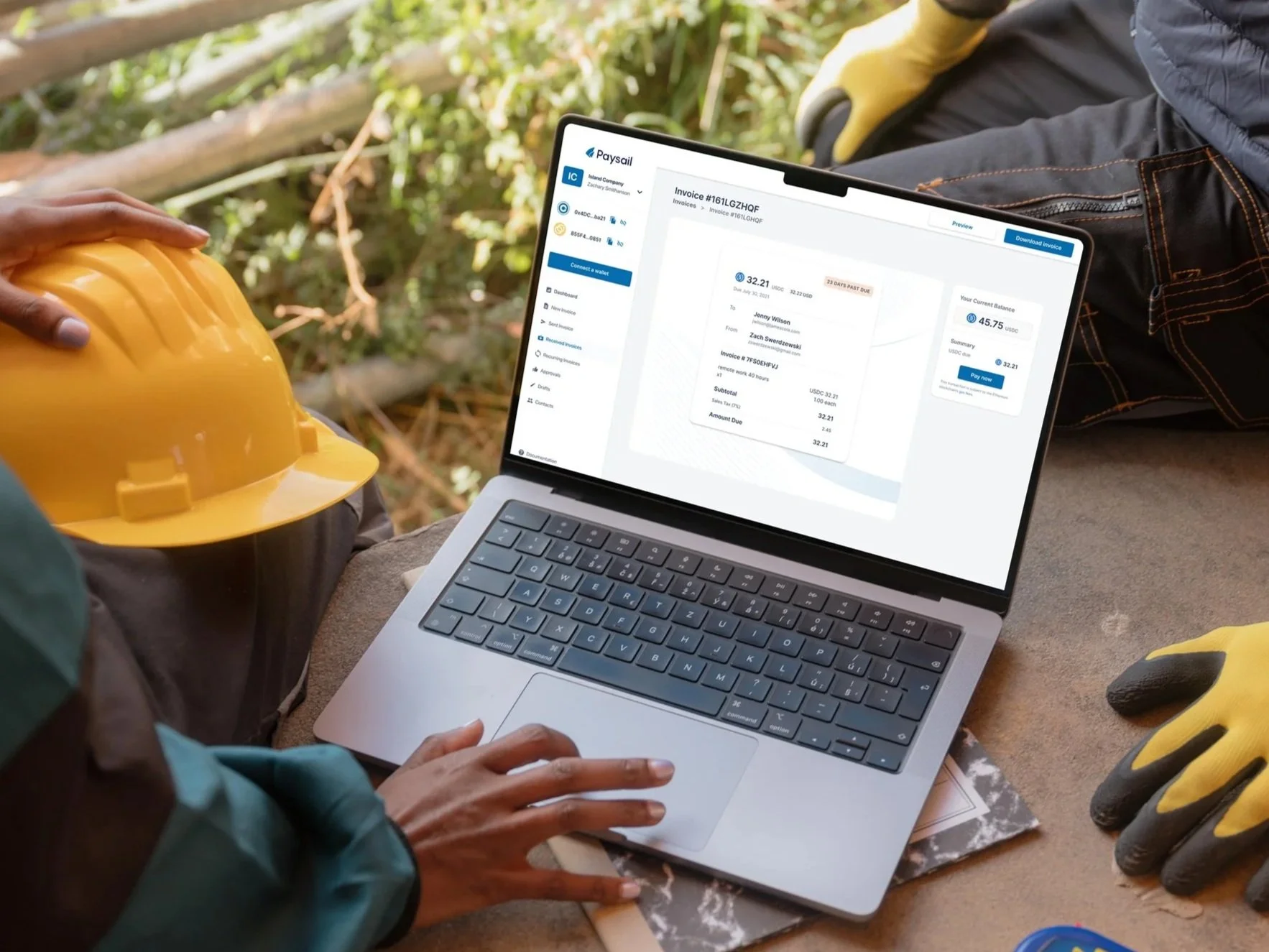

Invoice Details with Payment Button

Invoices List

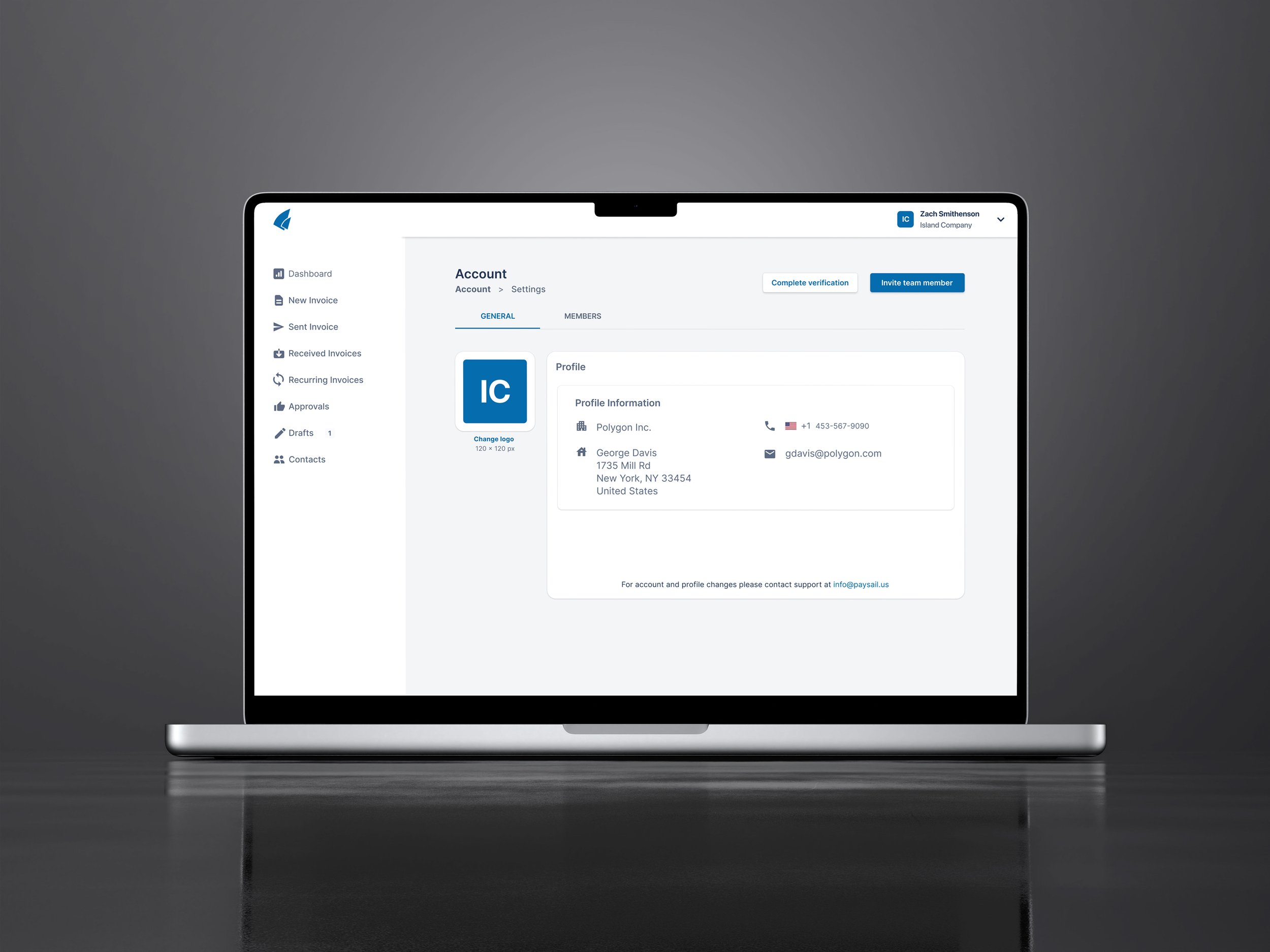

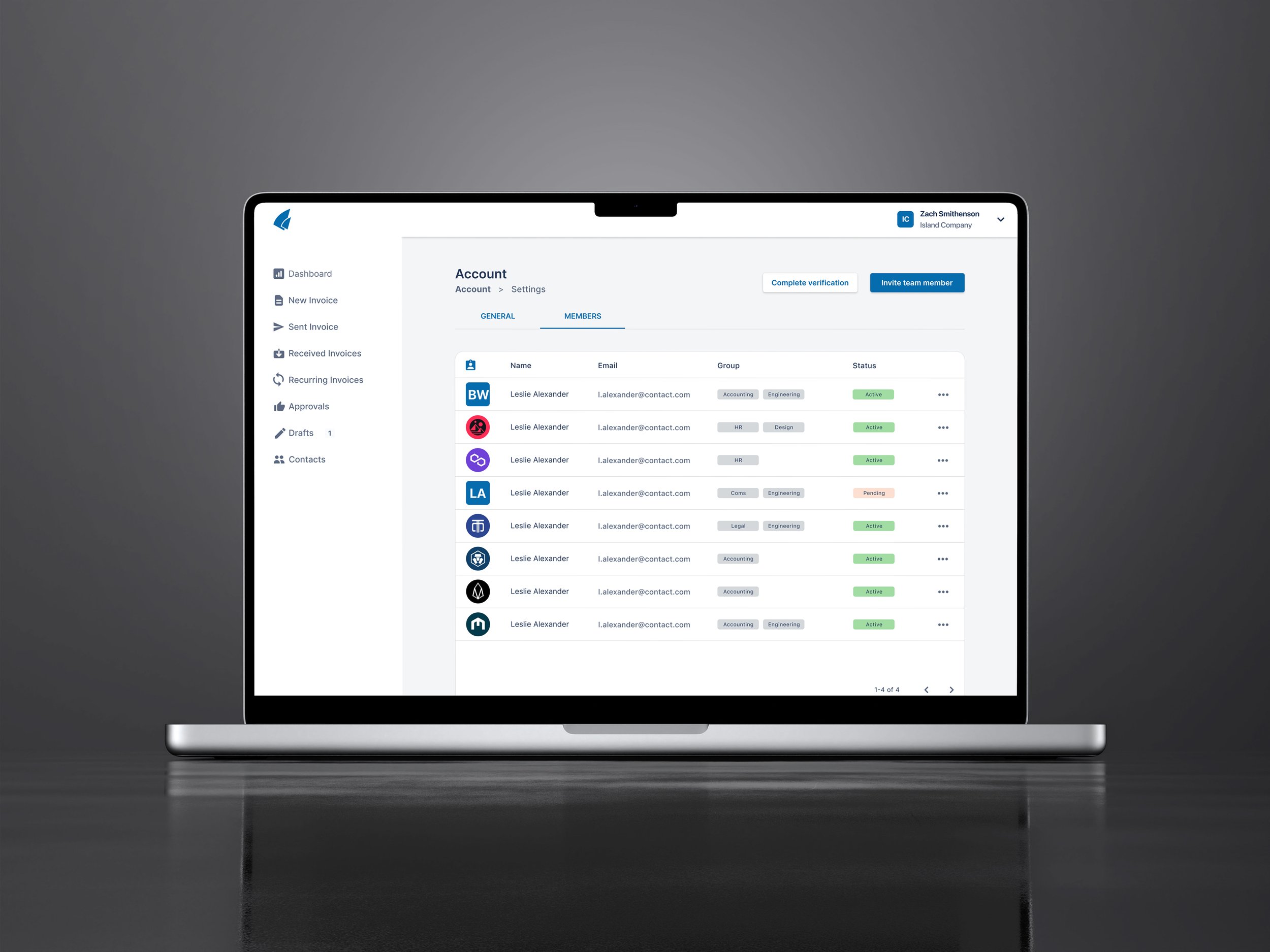

Account Details

Customer List

KYB - Know Your Business

03

Designing a Clearer, Smarter Invoicing Experience

What I Focused on

My goal was to create a desktop platform that felt powerful, modern, and trustworthy—while making complex processes feel simple.

Key focus areas:

Dashboard Clarity — Surfaced wallet balances, transactions, and invoices immediately on login.

Atomic Design System — Built a modular system enabling 200+ production-ready screens.

Compliance by Design — Integrated KYC, KYB, and AML flows that balanced security with smooth onboarding.

Cross-Currency Flexibility — Enabled invoices in both fiat and crypto, with partial, recurring, and mixed payments.

Lean Collaboration — As the sole designer, worked daily with founders and developers to shape product direction and iterate quickly.

04

Results & Impact

Introducing a New Standard for Crypto-Friendly Invoicing

The final experience delivered one of the first platforms that seamlessly blended Web2 simplicity with Web3 financial infrastructure.

Impact delivered:

200+ Production Screens — A fully functional 0→1 invoicing platform ready for alpha launch.

Instant Financial Visibility — Users immediately understood wallet balances, transactions, and invoice activity.

Regulatory Confidence — KYC, KYB, and AML built directly into the experience.

Cross-Border Speed — Enabled global payments using stablecoins, drastically reducing friction.

Scalable Foundations — The design system supported future features, subscription layers, and advanced workflow automation.

Early feedback showed users were able to:

send invoices faster,

understand their financial picture more clearly,

and onboard into crypto invoicing with far less confusion.